We’ve also included a couple of solutions that nearly made our list and a few products you can skip. Accounting software is like a database for all of your business’s financial transactions. It helps you follow basic accounting principles so that you can keep your books up to date and in order, which is especially important come tax season. Most software uses double-entry accounting, meaning it factors in assets, liabilities and equity, in addition to revenue and expenses. Businesses and companies need to conduct reconciliation to ensure the consistency and accuracy of financial accounts and records within the business.

How Tomo drove efficiency and slashed time to close with Ramp

A reconciliation is the process of comparing internal financial records against monthly statements from external sources—such as a bank, credit card company, or other financial institution—to make sure they match up. Reconciliation in accounting—the process of comparing sets of records to check that they’re correct and in agreement—is essential for ensuring the accuracy of financial records for all kinds of businesses. For the legal profession, however, regular, effective reconciliation in accounting is key to maintaining both financial accuracy and legal compliance—especially when managing trust accounts.

How Often Should Individuals Reconcile Their Bank Statements?

By practicing regular reconciliation, businesses protect their integrity, demonstrating a commitment to accuracy and transparency. This enhances trust among stakeholders, https://www.kelleysbookkeeping.com/what-is-a-current-liability/ including investors, employees, customers, and vendors. This not only keeps operations running smoothly but also helps avoid unnecessary financial strain or surprises.

Accounting reconciliation 101: What it is, why it matters and how to do it

An investigation may determine that the company wrote a check for $10,000 which has not yet cleared the bank. In this case, a $10,000 timing difference due to an outstanding check should be noted in the reconciliation. There may be instances where activity that is captured in the general ledger is not present in the supporting data or vice versa, due to a difference in the timing in which the transaction is reported.

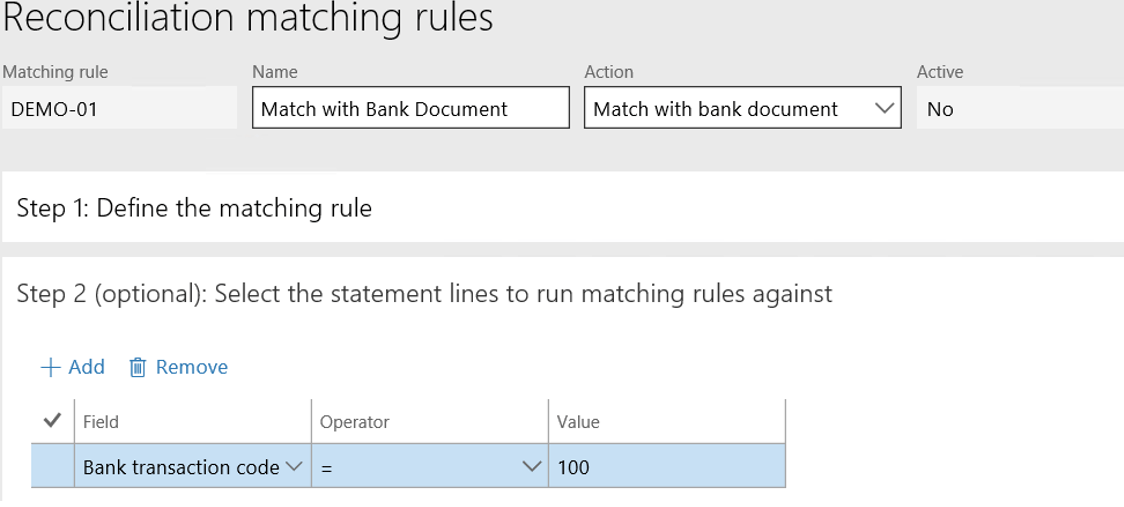

- Most accounting systems and ERPs have built-in modules that can import bank transactions and compare them to the transactions in the system.

- BlackLine Transaction Matching further automates processes by enabling the comparison and validation of transaction-level account data.

- You will also want to choose software that uses the accrual basis accounting method for recording transactions.

The form needs to provide you with enough space to add any outstanding items that will resolve any discrepancies between the two balances. I was excited until I realized my primary job was to reconcile five bank accounts, none of which had been reconciled for over a year. These steps can vary depending on what accounts you are reconciling, but the underlying premise is always the same – compare your ending balance against supporting documentation and make any adjustments as needed. While the reconciliation process remains the same, with two sets of documents compared for accuracy, the difference lies in what is being reconciled. While reconciling your bank statement, you notice the bank debited your account twice for $2,000 in error.

Check For Bank Errors

Reconciling these accounts is usually a simple matter of making sure that the balance in the relevant subledger or schedule matches the balance in the general ledger. Since 2006, when Sarbanes-Oxley became effective, public companies have been required to have internal controls that are adequate to prevent material misstatement. Performing regular balance sheet account reconciliations and reviewing those reconciliations is one form of internal control. Auditors will always include reconciliation reports as part of their PBC requests. It may seem obvious, but this is essential for making sure the accounting records are right. That’s how we know the financials are accurate — or at least materially correct — every month.

It may be necessary to adjust some journal entries if they were booked incorrectly. Stripe’s reconciliation process involves comparing your business’s internal records, such as invoices, with external records such as settlement files, payout files and bank statements. Stripe’s automated system handles this comparison, enabling you to capture revenue accurately and reconcile your internal accounting systems with Stripe-processed charges and refunds at a transaction level.

It is reimbursed for the incorrect deductions and rectification of these transactions brings consistency and accuracy to the receipts account, bank statement balance, and cash book balance. For example, while performing an account reconciliation for a cash account, it may be noted that the general ledger balance is $249,000. Still, the supporting documentation (i.e., a bank statement) says the bank account has a balance of $249,900. For example, while performing an account reconciliation for a cash account, it may be noted that the general ledger balance is $500,000. Still, the supporting documentation (i.e., a bank statement) says the bank account has a balance of $520,000. In the world of accounting, reconciliation is not just a term; it is an essential tool for ensuring accuracy, maintaining financial health, and fostering trust.

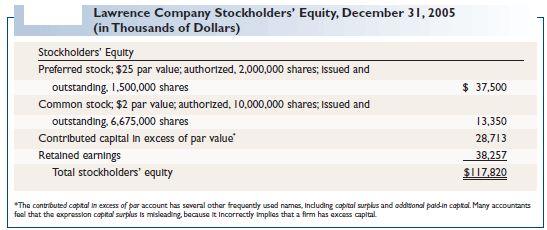

Other reconciliations turn non-GAAP measures, such as earnings before interest, taxes, depreciation, and amortization (EBITDA), into their GAAP-approved counterparts. Reconciliation is an accounting procedure that compares two sets of records to check that the figures are correct and in agreement. Reconciliation also confirms that accounts in a general ledger are consistent and complete.

You will need to give special importance to reconciling accounts receivables to ensure steady cash flow and good customer relations to name just a few reasons. You will need to check the bank and ledger balances to ensure that there are no short payments, deductions, disputes, and to stop credit facility for defaulting customers. There could be transactions unaccounted for in your personal financial records because of a bank adjustment.

Account reconciliation is done to ensure that account balances are correct at the end of an accounting period. The account reconciliation process also helps to identify any outstanding items that need to be taken into consideration in the reconciliation process. The process of account reconciliation provides businesses with the opportunity to notify https://www.quickbooks-payroll.org/ the bank (or other external source of statements) of errors and have them corrected. This is critical because any discrepancies left unaddressed could distort a company’s understanding of its financial health. The first step in bank reconciliation is to compare your business’s record of transactions and balances to your monthly bank statement.

On a regular basis, usually at the end of each month, bookkeepers or accountants review each account in the general ledger. The review involves matching the ledger’s transactions against external records, such as bank statements. Any irregularities discovered during this stage must be investigated and corrected to maintain the integrity of financial records.

Cash flow can be calculated through either a direct method or indirect method. GAAP requires that if the direct method is used, the company must still reconcile cash flows to the income statement and balance sheet. Some reconciliations are necessary to ensure that cash inflows and outflows concur between the income statement, balance sheet, and cash flow statement. Another way of performing a reconciliation is via the account conversion method.

Accounting reconciliation plays a fundamental role in ensuring that financial statements are reliable, detecting errors, preventing fraud and maintaining compliance with regulatory requirements. Businesses that prioritise effective reconciliation practices put themselves in a strong position to make informed decisions, mitigate risks and maintain the financial health necessary for long-term success. NerdWallet independently reviews what is general ledger gl definition from whatis com accounting software products before determining our top picks. We collect the data for our software ratings from products’ public-facing websites and from company representatives. Information is gathered on a regular basis and reviewed by our editorial team for consistency and accuracy. When you reconcile accounts, you compare two or more sources of a company’s accounting to check for errors and bring them into agreement.

Another factor that seems to be unavoidable, no matter how diligent your accounting team is, is the total boycott of a transaction. Comparing accounts helps you spot transactions you have missed and keeps all your records as consistent with each other and accurate as possible. Account reconciliations can vary, including bank reconciliation, vendor reconciliation, customer reconciliation, and inter-company reconciliation. The reconciliation process is typically done on a regular basis, often monthly. To prepare, one should identify the specific period that the reconciliation will cover. The trial balance that lists and totals general ledger account balances should have equal debit and credit totals to reflect double-entry accounting and posting of all accounts to the general ledger.